Calculate payroll deductions manually

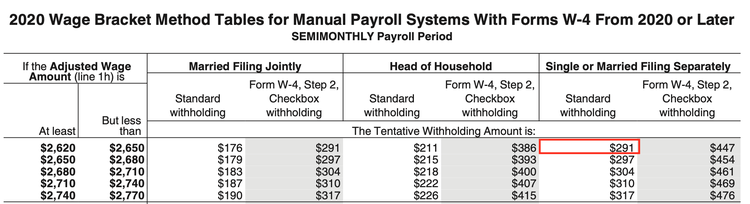

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. How to Do Payroll Manually.

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Her yearly standard deduction is 430000.

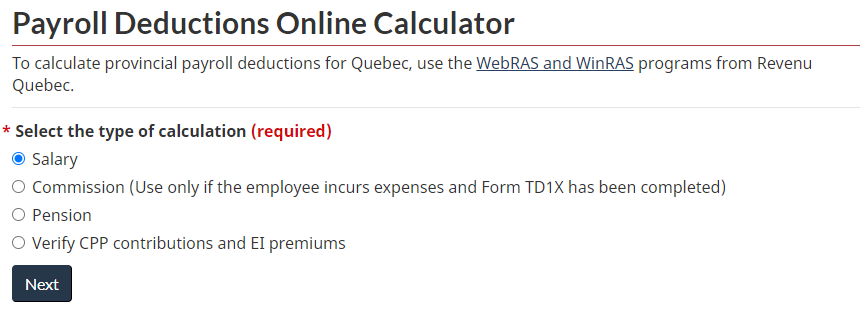

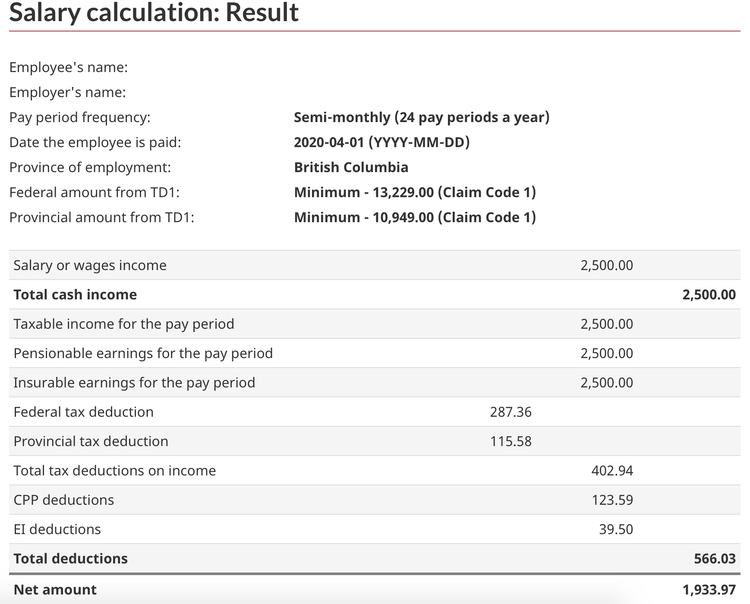

. Payroll deductions online calculator. For more information on the manual calculation method see the instructions in the section called Step-by-step calculation of tax deductions in Section A of the guide T4032. How do you calculate payroll deductions.

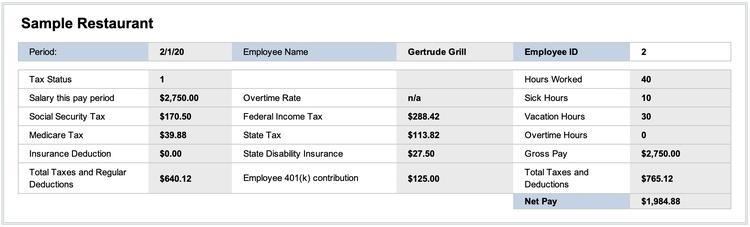

A W-4 form is an IRS form that documents an employees status so that the employer can. To calculate the gross pay for a salaried employee divide their yearly salary by how many times you will run payroll during the year. Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

If you pay salaried employees twice a month there are 24 pay. Calculate taxes youll need to withhold and additional taxes youll owe Pay your employees by subtracting taxes and any other deductions from employees earned income Remit taxes to. Im having a hard time find this specific topic Calculate payroll manually without a subscription to QuickBooks Payroll that this QuickBooks topic references Set up payroll.

The first step is the easiest as all that you need to do is multiply the employees hours worked. Steps to calculate the 2021 tax manually. Each of your employees needs to fill out a W-4 form.

Check the yearly tax. Gross wages are your employees compensation before payroll deductions including employee-paid payroll taxes and contributions to retirement and health plans. The Payroll Deductions Tables help you calculate the Canada Pension Plan CPP contributions employment insurance EI premiums and the amount of federal provincial except Quebec.

Determine the employees gross wage. Her yearly taxable income is. For example if you run payroll on the first day of every.

Use these calculators and tax tables to check payroll tax national insurance contributions and calculate payroll deductions manually student loan. Use this simplified payroll deductions calculator to help you determine your net paycheck. PAYE Collection Check your payroll calculations manually Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan.

That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period.

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Enter Payroll Taxes Manually

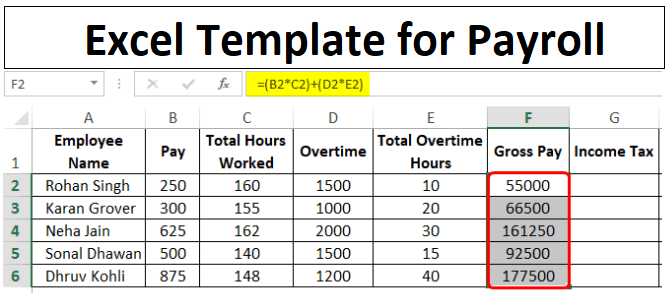

Excel Template For Payroll How To Create Payroll Template In Excel

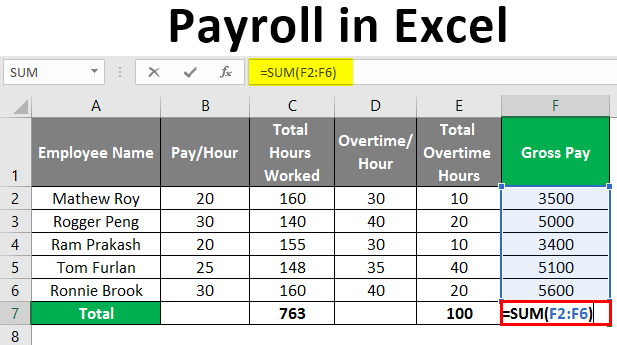

Payroll In Excel How To Create Payroll In Excel With Steps

How To Enter Payroll Taxes Manually

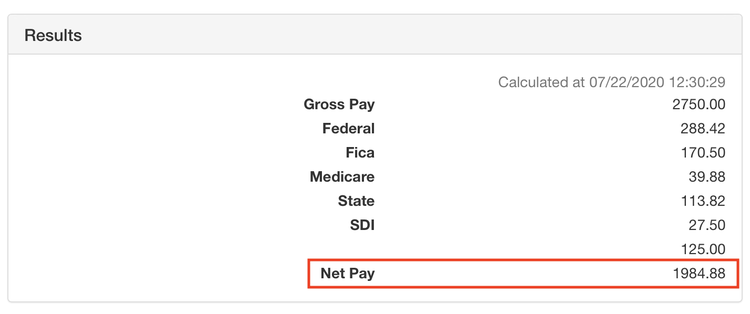

How To Calculate Payroll Taxes In 5 Steps

A Small Business Guide To Doing Manual Payroll

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

A Small Business Guide To Doing Manual Payroll

How To Manage Payroll Yourself For Your Small Business Gusto

A Small Business Guide To Doing Manual Payroll

Manually Enter Payroll Paychecks In Quickbooks Online

How To Calculate Payroll Taxes Methods Examples More

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Choose Right Paystub Generator For Business Administrative Jobs Business Financial Advice

How To Do Payroll In Canada A Step By Step Guide